Netheos products

Trust & Sign

The 100% French API platform

Trust and Sign is an API platform in SaaS mode. It responds to the main challenges of remote entry and subscription by offering solutions for :

- Remote identity verification

- eIDAS-certified electronic signatures

- Automated verification of supporting documents

These companies put their trust in us. Join them!

Trust & Sign benefits

Wide range of identification systems

5 remote identity verification solutions with ®Facematch facial recognition and active or passive life detection.

Omnichannel solution

Trust and Sign can be used as a white label for all our fully integrated solutions.

Operational efficiency

The T&S back-office optimizes the manual removal of doubt, catch-up and reopening of files.

Total control

The product’s technical base is 100% developed in-house.

Reminders and notifications

Intelligent systems (email, SMS, webhook) bring maximum flexibility to the implementation of cross-channel workflows.

Integrated reporting and tracking system

You can easily monitor your workflows by receiving periodic summaries of your activities: files created, finalized, rejected.

Dynamic fraud database

Helps prevent hemorrhagic identity fraud via a declarative and dynamic database, shared between our different customers.

High availability

Hosted in 2 secure centers in France, T&S benefits from a high availability rate (99.985% by 2022), guaranteeing access around the clock.

3 secure electronic signatures

100% certified at European level (eIDAS regulation), they include support in the event of litigation and financial coverage in the event of legal rejection.

Do you have any questions?

Talk to one of our solution experts and find out how Trust & Sign can help you with your remote sign-up and subscription processes.

Trust & Sign meets your needs

- Transformation and fluidity of digital processes, with a simple and secure electronic signature associated with machine learning automation.

- Regulatory compliance and the fight against fraud, with the verification of the client’s identity associated with the control of completeness, compliance and documentary fraudKYC / LCB-FT).

- Simplify the remote subscription process thanks to the One Click Contract feature, which recognizes a customer by telephone number and email address.

Hosting in France in 5 independent secure centers

Including 2x2 active-active clusters to balance workloads across multiple active servers to preserve the security and high availability of your data in the event of an unexpected component failure.

SLA Uptime Level

-

2021

Arkhinéo archiving of signed documents and evidence file

The Arkhinéo (formerly Caisse des Dépôts et Consignation) Electronic Archiving Solution (EAS) is easily auditable and enforceable in the event of a dispute, even if you are no longer a Netheos customer.

Secure identity verification with ®Facematch

Netheos’ proprietary ®Facematch facial recognition solution brings an extra level of security to identity verification!

- Machine Learning algorithm protects against identity theft by ensuring that the person making the journey matches the owner of the ID document

- Simple operation via a camera integrated into a smartphone, tablet or computer

- 3 ®Facematch solutions to suit your compliance and security needs: ®Facematch Photo, ®Facematch Video and ®Facematch MAX

The widest range of identity verification solutions on the market

A true hub of integrated solutions, Netheos offers a complete catalog of remote identity verification solutions to meet your needs and regulatory obligations:

Netheos ID

The solution for companies with few or no regulatory constraints. Analyze all ID documents in 3 seconds, thanks to fast, reliable and consistent artificial intelligence, 95% without human verification.

Facematch: None

Usage: ID document verification without facial recognition

-

Capture identity document

Users take photos of their documents with their smartphone, or download them if they have previously captured or scanned them.

-

Document quality control

The user checks that the quality of the document conforms to specifications (sharpness and completeness). He can start again if necessary.

-

Sending the document for analysis

Our AI will then check the document for 4 points: quality, type, authenticity and consistency. The user receives feedback in a maximum of 3 seconds.

In the event of an error, the user is notified of the precise nature of the error, and offered advice on how to correct it and get back on track.

Netheos ID+

Eliminate the risk of identity theft with our ®Facematch Photo facial recognition technology! The fully-guided path gives you a very high conversion rate, with an average completion time of 48 seconds.

Facematch: Photo

Usage: ID document verification with facial recognition

-

Capture identity document

Users take photos of their documents with their smartphone, or download them if they have previously captured or scanned them.

-

Document quality control

The user checks that the quality of the document conforms to specifications (sharpness and completeness). He can start again if necessary.

-

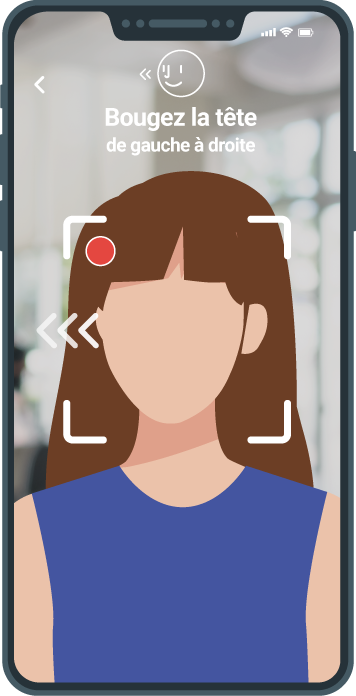

Active facial recognition

The user needs to make brief movements to guarantee his presence and liveliness. This step ensures that the user is the legitimate holder of the identity document.

-

Sent for analysis

Final verification is carried out according to 3 different levels of automation: 100% automatic (based on AI controls), hybrid (configurable human intervention) or 100% manual.

Netheos ID FAST

Fight identity theft and benefit from the highest conversion rate thanks to our identity verification solution offering the best user experience on the market, in less than 40 seconds.

Facematch: Video

Use: eIDAS-certified Qualified Electronic Signature (QES)

-

Video capture of identity document

Capture is live: the user frames his document, which he must have in his possession.

-

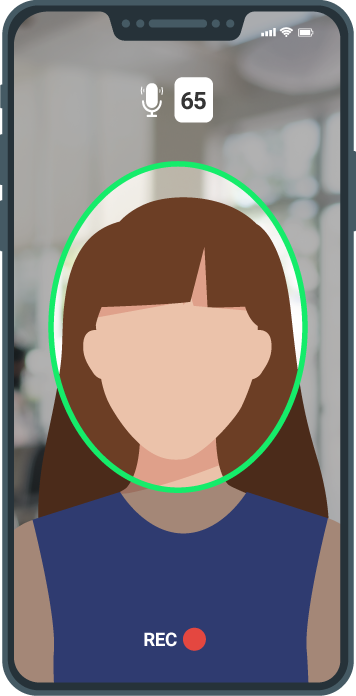

Passive facial recognition

At this stage, live detection is passive and transparent for the user: no action is required. This step ensures that the user is the legitimate holder of the identity document.

-

Sent for analysis

Final verification is carried out according to 3 different levels of automation: 100% automatic (based on AI controls), hybrid (configurable human intervention) or 100% manual.

Netheos ID MAX

Verify remote identity with our PVID course, currently being certified by ANSSI. Thecombination of AI and people, available 24/7 and based in France, with an end-to-end journey in less than 2 minutes.

Facematch: MAX (Video + challenge)

Usage: PVID course (currently being certified by ANSSI)

-

Video capture of identity document

Capture is live: the user frames his document, which he must have in his possession.

-

Checking the authenticity of identity documents

Manipulations are required to verify that the title is authentic by detecting embossing, inks and holographic visual effects.

-

Passive facial recognition

At this stage, live detection is passive and transparent for the user: no action is required. This step ensures that the user is the legitimate holder of the identity document.

-

Active facial recognition

To reinforce identity control, active liveliness detection is required: the user must speak 3 random digits, which appear on the screen.

-

Sent for analysis

The final verification is carried out by a human operator who, with the help of Artificial Intelligence, checks the authenticity of documents and videos. At Netheos, this service is staffed by anti-fraud experts based in France and available 24/7. We guarantee a final result in less than 5 minutes.

Would you like to find out more?

Make an appointment with our team to explore how Trust & Sign enables you to verify your users’ identities quickly, efficiently and without losing conversion.

Simple, fast, documented integration

Web App

To get started as quickly as possible, simply insert a link to our Web App in one of your pages, and off you go!

Iframe

Our web components are inserted into your pages to ensure the most seamless customer experience.

REST API

Our APIs give you access to all our services, enabling you to integrate our functionalities into the heart of your application.

They tell us how Netheos has helped them grow.

“Netheos has improved our transformation rate throughout the entire process. Above all, it has significantly shortened transformation times. And clearly, very significantly, improved return rates. “

Executive Vice-President

Floa Bank (Banque Casino)

“Thanks to our partnership with NETHEOS, customers can take out a loan entirely online. We are continuing to deploy the solution in our various routes for functions that are increasingly in demand, such as anti-fraud. “

Project Manager

Franfinance

“Netheos offers a low-code subscription path for the integrator that will enable us to accept today and tomorrow all the new technologies needed to achieve the finest user experience.”

CISO

CNP Assurances

Contact us!

Fill in the form and we will contact you as soon as possible.

You can discover :

- How we can meet your specific needs and expectations

- A personalized demo, allowing you to appreciate the fluid experience we offer

- Customer feedback and case studies of similar companies that have integrated our solutions

- Advantages, benefits and value according to your use case