Identity verification

Netheos ID+

The fastest remote identity verification with facial recognition

Eliminate the risk of identity theft with ®Facematch and an average end-to-end user journey time of 48 seconds.

These companies put their trust in us. Join them!

Netheos ID+ benefits

Contract with your customers remotely

Fraud detection

Eliminate the risk of impersonation by verifying the user’s face

All-support accessibility

No application download, from any terminal

Time savings

Automated checks

Cost reduction

Automation cuts processing times

Different levels of automation

Define precisely the degree of automation of checks

Optimized user experience

Accompanying the user in a quick and easy process

Do you have any questions?

Talk to one of our solution experts and find out how Netheos helps you verify identities remotely.

Secure identity verification with facial recognition

The ®Facematch facial recognition solution from Netheos brings an extra level of security to identity verification by ensuring that the person making the journey is actually the owner of the ID document.

This feature is based on a facial recognition algorithm and protects against identity theft when the journey is carried out remotely. Users can now confirm their identity securely using an integrated camera on a smartphone, tablet or computer.

How Netheos ID+ works

Our solution is accessible via all media (computers, mobiles, tablets). The process is done entirely online and is carried out in 4 quick and easy steps:

-

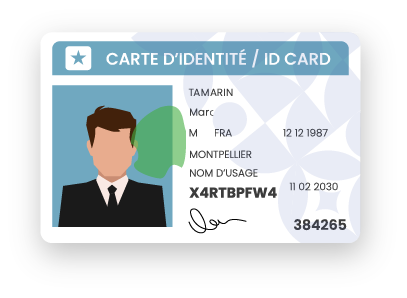

Capture identity document

Users take photos of their documents with their smartphone, or download them if they have previously captured or scanned them.

-

Document quality control

The user checks that the quality of the document conforms to specifications (sharpness and completeness). He can start again if necessary.

-

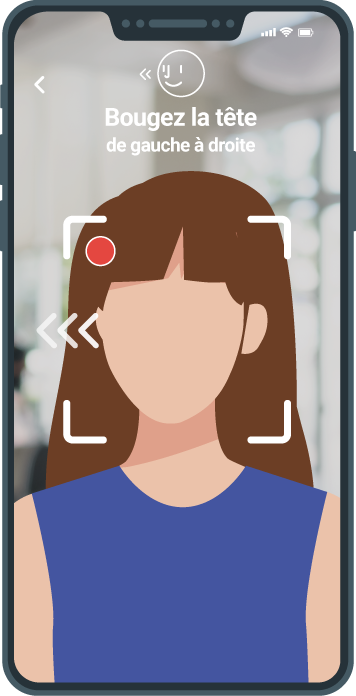

Active facial recognition

The user needs to make brief movements to guarantee his presence and liveliness. This step ensures that the user is the legitimate holder of the identity document.

-

Sent for analysis

Final verification is carried out according to 3 different levels of automation: 100% automatic (based on AI controls), hybrid (configurable human intervention) or 100% manual.

Netheos ID+ key figures

+350 international titles supported

Passports, identity cards, residence permits from all over the world.

48 seconds

Average end-to-end user journey time.

93%

Fully completed courses.

Would you like to find out more?

Make an appointment with our team to find out how Netheos solutions can help you verify your users’ identities quickly and efficiently, without any loss of conversion time.

They tell us how Netheos has helped them grow.

“Netheos has improved our transformation rate throughout the entire process. Above all, it has significantly shortened transformation times. And clearly, very significantly, improved return rates. “

Executive Vice-President - Floa Bank (Banque Casino)

“Thanks to our partnership with Netheos, customers can take out a loan entirely online. We are continuing to deploy the solution in our various routes for functions that are increasingly in demand, such as anti-fraud. “

Project Manager - Franfinance

“Netheos offers a low-code subscription path for the integrator that will enable us to accept today and tomorrow all the new technologies needed to achieve the finest user experience.”

CISO - CNP Assurances

Protect yourself against blood fraud

Fraudsters have also taken to automation, able to create hundreds of fraudulent coins in a matter of seconds, from a single real card recovered.

The process can be simple: using the same background map, text data can easily be falsified.

We have devised a proprietary fraud database, shared by all our customers, which lists these counterfeit documents:

- Document previously declared fraudulent

- Document containing the same base map with different information

- Document presented too close together

The algorithms are capable of quickly recognizing a card already in the database.

This feature is based on a facial recognition algorithm and protects against identity theft when the journey is carried out remotely. Users can now confirm their identity securely using an integrated camera on a smartphone, tablet or computer.

FAQ

What checks are carried out?

We analyze the quality of the identity document, its consistency and authenticity. We compare the facial image with the user’s photo to prevent identity theft. Live detection ensures that the user is active and that it’s not a presentation (video, photo, use of masks).

How is living matter detected?

Our ID+ solution provides active face detection: the user must make a head movement. This doesn’t add a step for the user, as the verification is performed during face capture. This takes less than 7 seconds.

How is the user supported during verification?

To guarantee a high level of conversion, the user is accompanied live throughout the entire process. Textual and visual elements show him how to shoot. Frames and dynamic elements simply inform you of the quality of your capture (brightness, sharpness, layout).

Do you have operators to carry out manual checks?

Yes, we have a team of experts in the fight against document and identity fraud, capable of manually verifying identity. We leave it up to you to decide whether to let us handle this part of your business, or to manage it yourself in-house.

Can the user send a previously captured part?

Yes, users can submit a document if they have already scanned or photographed their ID beforehand.

Contact us!

Fill in the form and we will contact you as soon as possible.

You can discover :

- How we can meet your specific needs and expectations

- A personalized demo, allowing you to appreciate the fluid experience we offer

- Customer feedback and case studies of similar companies that have integrated our solutions

- Advantages, benefits and value according to your use case