Identity verification

Netheos ID MAX

The most secure video identity verification with a unique experience

Verify remote identity with our Remote Identity Verification Provider (PVID) certified by ANSSI. The combination of AI and people, 24/7, with a response in less than 5 minutes.

These companies put their trust in us. Join them!

The benefits of Netheos ID MAX

Secure verification process

The course includes a random, non-replayable challenge.

Fraud detection

Eliminate the risk of usurpation through facial recognition.

Maximum safety

Regularly audited, the solution meets precise specifications.

Regulatory compliance

The solution is PVID certified by ANSSI.

100% web course

Available without application download.

Optimized user experience

Quick and easy user guidance.

Do you have any questions?

Talk to one of our solution experts and find out how Netheos helps you verify identities remotely.

Ensure safety and regulatory compliance

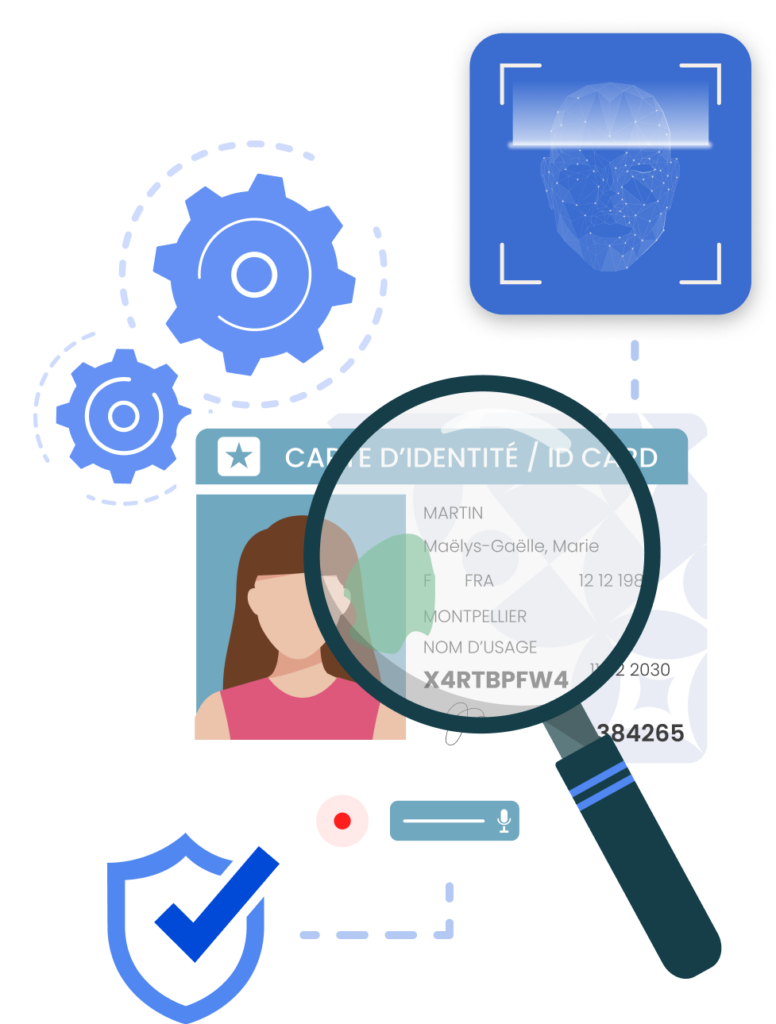

The ®Facematch MAX facial recognition solution from Netheos brings an extra level of security to identity verification by ensuring that the person making the journey is actually the owner of the ID document.

This feature is based on a facial recognition algorithm and protects against identity theft when the journey is carried out remotely.

ID Max is PVID-certified by ANSSI. It will enable organizations subject to LCB-FT (Fight Against Money Laundering and Terrorist Financing) regulations to comply with the 5th additional vigilance measure of the French Monetary and Financial Code.

The solution uses “user challenges” to complete the live recognition that ensures the non-replayable nature of the videos. These challenges prevent malicious users from reusing them for identity theft.

How Netheos ID MAX works

Our solution is accessible via all media (computers, mobiles, tablets). The process is done entirely online and is carried out in 4 quick and easy steps:

-

Video capture of identity document

Capture is live: the user frames his document, which he must have in his possession.

-

Checking the authenticity of identity documents

Manipulations are required to verify that the title is authentic by detecting embossing, inks and holographic visual effects.

-

Passive facial recognition

At this stage, live detection is passive and transparent for the user: no action is required. This step ensures that the user is the legitimate holder of the identity document.

-

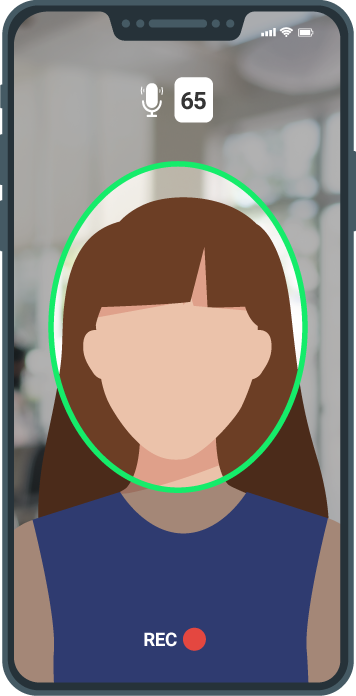

Active facial recognition

To reinforce identity control, active liveliness detection is required: the user must speak 3 random digits, which appear on the screen.

-

Sent for analysis

The final verification is carried out by a human operator who, with the help of Artificial Intelligence, checks the authenticity of documents and videos. At Netheos, this service is staffed by anti-fraud experts based in France and available 24/7. We guarantee a final result in less than 5 minutes.

Netheos ID MAX key figures

24/7

Our anti-fraud experts are available 24/7.

2 minutes

Average end-to-end user journey time.

5 minutes

Our anti-fraud experts guarantee a final result in less than 5 minutes.

Would you like to find out more?

Make an appointment with our team to find out how Netheos solutions can help you verify your users’ identities quickly and efficiently, without any loss of conversion time.

They tell us how Netheos has helped them grow.

“Netheos has improved our transformation rate throughout the entire process. Above all, it has significantly shortened transformation times. And clearly, very significantly, improved return rates. “

Executive Vice-President - Floa Bank (Banque Casino)

“Netheos offers a low-code subscription path for the integrator that will enable us to accept today and tomorrow all the new technologies needed to achieve the finest user experience.”

CISO - CNP Assurances

Project Manager - Franfinance

FAQ

What impact does PVID have on the customer experience?

The PVID standard standardizes practices. Its requirements have several impacts on the user experience:

- A lengthening of the route, requiring several defined stages and challenges, making the experience less fluid.

- Technical constraints on the capture device: high definition, number of frames per second.

- Asynchronous response through systematic manual checking to ensure reliable and accurate verification.

Is human verification mandatory?

Yes, this is one of ANSSI’s requirements for PVID. The final verdict must be given by a human, an operator authorized to carry out this operation, and based at the certified service provider’s premises.

How is the user challenge innovative?

We’ve patented our challenge to make the user experience unique. The aim is to efficiently verify user identity while reducing the risk of abandonment. Our verification process is as simple as possible. We wanted to create a playful, gamified experience with as few movements as possible.

When will the course be certified by ANSSI?

Namirial France received PVID certification from ANSSI for its Netheos product on December 14, 2023.

When is identity verification used?

This service will be equivalent to a face-to-face check. It will enable organizations subject to the Monetary and Financial Code to comply with the regulation, in particular with their customer due diligence obligations. It responds to the 5th measure concerning the use of a certified service with a substantial guarantee level.

More generally, this verification process can be used by other sectors wishing to benefit from the highest level of security and a rigorously audited solution.

Contact us!

Fill in the form and we will contact you as soon as possible.

You can discover :

- How we can meet your specific needs and expectations

- A personalized demo, allowing you to appreciate the fluid experience we offer

- Customer feedback and case studies of similar companies that have integrated our solutions

- Advantages, benefits and value according to your use case