Digital customer onboarding: definition

Digital customer onboarding, also known as “entrée en relation à distance“, is a process for welcoming and integrating new customers into a company using totally paperless tools and procedures. This process aims to simplify, automate and optimize all the steps needed to turn a prospect into an active customer, while ensuring a smooth and secure user experience.

Thanks to effective digital customer onboarding, your company can not only save time and increase efficiency, but also offer added value to your customers in terms of ease of use and confidence in your services.

Here are the key principles of this process:

- Automation: Use of IT systems to reduce the need for human intervention, thus speeding up the registration process and reducing manual errors.

- Security and compliance: Implementation of robust security mechanisms to protect customer data and ensure compliance with current regulations such as GDPR, KYC (Know Your Customer) and AML (Anti-Money Laundering).

- Optimized user experience: intuitive, accessible interfaces that guide customers through the process effortlessly and with a clear understanding of the steps involved.

- Personalization: Tailoring the customer’s experience of a remote relationship to his or her specific needs, in order to boost commitment and satisfaction.

- Implementation of remote identity verification solutions: Use of technologies such as biometric recognition, ID document analysis or video identification to confirm customer identity reliably and without the need for physical presence.

When does customer onboarding begin?

The digital onboarding of a customer begins with the first contact between your company and the person or entity who intends to benefit from your services or products. At this initial stage, remote contact is used to simplify, speed up and secure the process of making contact and establishing a long-lasting, effective relationship with the new customer.

In the digital world, first impressions are crucial. So, as soon as the prospect shows interest in your offer – whether through your website, a mobile app, or any other digital interface – digital onboarding takes shape. From this point on, every interaction is designed to guide the prospect towards a clear understanding of what you offer and how they can benefit from it.

This involves a structured procedure that may include the creation of a user account, the collection of basic information, and in the case of remote identity verification, the initiation of secure and regulated protocols to validate the potential customer’s identity before proceeding with any commercial transaction.

Digital onboarding is therefore the portal through which your customers will go from being mere visitors to integrated members of your business or community ecosystem. A well-oiled process is synonymous with a pleasant customer experience, and can significantly influence customer loyalty. It is essential to ensure that the transition is seamless and presents no technical or bureaucratic obstacles that might dissuade customers from finalizing their commitment.

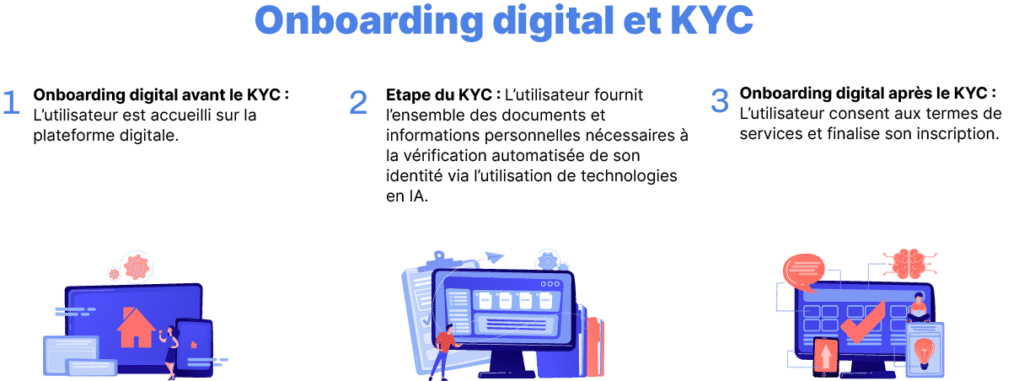

What's the link between customer onboarding and KYC?

Digital customer onboarding and the KYC (Know Your Customer) process are closely linked and complement each other when it comes to establishing a relationship between a company and a new customer in a digital environment.

KYC refers to the set of regulatory procedures that companies, particularly those in the financial sector, must follow to verify the identity of their customers. It is an essential component in the fight against money laundering, terrorist financing and other illegal activities. The aim is to ensure that the identity declared by the customer is genuine, to understand the nature of the customer’s commitment and to assess the potential risks of a business relationship with the customer.

As part of digital onboarding, KYC becomes an integral part of the online customer registration or welcome procedure. This usually means that you, as a company, will need to collect reliable personal data and identity documents to verify the customer’s identity. Thanks to technological advances, this verification can now be carried out remotely, using biometric recognition systems, document control via smartphone camera or webcam, and even the integration of live video verification techniques.

By offering a digital onboarding process that integrates KYC, you minimize friction by making verification quick and accessible, while complying with regulatory standards. This approach also builds trust with your customers, who will perceive your company as responsible and safe.

Make an appointment with one of our experts to find out how Netheos solutions can help you verify the identity of your users, securely and without loss of conversion.

What other types of customer onboarding are there?

In addition to digital onboarding, there are other forms of customer onboarding, such as traditional onboarding and hybrid onboarding. Each of these methods has its own specific features, depending on how it interacts with the customer and incorporates technological processes.

Traditional customer onboarding

This is the integration process often encountered in face-to-face interactions. This model was the norm before the digitization of services. It requires customers to physically go to a branch or point of service to provide their personal data and the documents needed for KYC. This type of onboarding may be more reassuring for some customers who prefer human contact and the ability to ask questions directly. However, this method is often more time-consuming and less convenient, due to the time required for manual data processing and the need for the customer to visit the site.

Hybrid customer onboarding

It combines the elements of traditional and digital onboarding. It enables customers to benefit from the ease and speed of the digital process, while still having access to human support and advice when needed. For example, a customer may start the onboarding process online by filling in forms and uploading documents, then complete the process at a branch or during an appointment with an advisor who will finalize identity verification or clarify certain aspects of the service.

Hybrid onboarding is particularly relevant for companies operating in sectors where trust is key, and where a purely digital approach may not be sufficient to reassure certain customer segments. This model allows us to maintain a balance between technological efficiency and personalized customer service.

As a company committed to meeting your customers’ expectations, it’s a good idea to assess their profile, their preferences and the level of digitalization they’re willing to accept. Your onboarding strategy needs to take these elements into account to deliver an optimal customer experience, whether it’s entirely digital, traditional or a hybrid of the two.

Why digitalize your customer onboarding?

Digitizing a customer onboarding process offers multiple advantages that can considerably improve both your company’s operational efficiency and your customers’ experience. Here are some of the highlights of adopting such a process:

Time saving

- Faster registration and verification.

- Reduced processing times thanks to automation.

Improving the Customer Experience

- Simplify and streamline the relationship.

- Significant increase in conversion and onboarding completion rates

- Accessible at all times and from all locations.

- Reduced customer effort compared to traditional procedures.

Cost reduction

- Reduce operational costs associated with paper handling and face-to-face interactions.

- Savings achieved by streamlining processes and reducing the resources allocated to physically greeting customers.

Safety and Regulatory Compliance

- Taking into account the many regulatory directives and standards (LCB-FT, GDPR, etc.) that require careful analysis of customer identity and thorough documentation.

- Integration of digitized KYC to ensure constant, automated compliance while adapting rapidly to legal changes.

- Use advanced technologies to verify identity, prevent cyber attacks and fraud.

Optimized Data Collection

- Ability to systematically collect and process customer data for improved tracking and personalization.

- Easy integration of information into CRM systems for improved analysis and customer segmentation.

Scalability

- Process adaptability and scalability as the company grows and customer volumes increase.

By investing in a digital onboarding process, you align your company with contemporary consumer expectations for fast, secure and frictionless onboarding. It’s a fundamental element in setting yourself apart from the competition and building customer loyalty in an increasingly digitalized world.

Find out more by downloading our free replay of the Webinar entitled “Webinars & Replays”.Customer onboarding: what can be done to increase conversion?”

Webinar

How do you go about digital customer onboarding?

To achieve good remote onboarding, it’s crucial to structure the process into clear, efficient steps that guarantee both regulatory compliance and an optimal user experience. Here’s an 8-step KYC process for customer onboarding when opening a bank account.

-

Home and Preamble

Start by welcoming the customer to your digital platform and explaining the steps involved in the onboarding process, as well as the importance of KYC in guaranteeing the security of the transaction.

-

Collecting basic information

Ask the customer to provide personal information, such as name, date of birth, address and contact details.

Let him choose the type of bank account he wants to open, and understand his financial needs. -

Document identification and control

Ask the customer to upload or take a photo of their official identity documents (ID card, passport, driver's license, etc.). Use advanced technologies such as OCR (optical character recognition) to extract information from documents and compare it with input data.

-

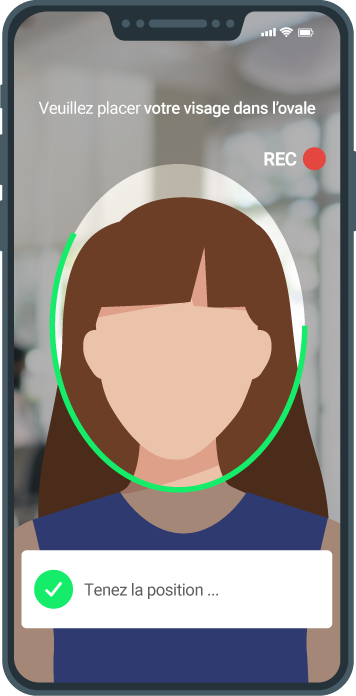

Biometric verification

Implement biometric verification processes such as Netheos ®Facematch Photo or Video facial recognition to compare the customer's face to the identity documents provided. In some cases, call on anti-fraud experts to verify the customer's identity in real time, to complement the results of artificial intelligence.

-

Information Verification and Screening

Perform automatic screening of collected information against relevant databases to detect any inconsistencies or red flags (Politically Exposed Persons, sanctions lists, etc.).

-

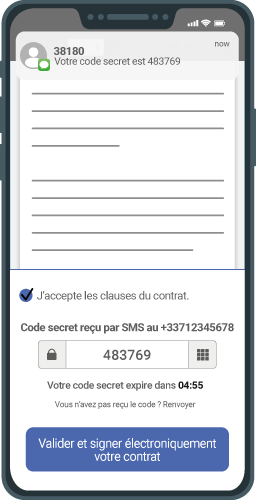

Consent and Agreement

Present the customer with the terms and conditions of the service, and obtain their electronic or digital consent.

-

Initial Deposit and Account Activation

Once all the steps have been completed and the information validated, confirm the opening of the account to the customer. Offer follow-up and support, for example, by sending a welcome e-mail and information on how to use the new account.

-

Continuous Integration

Offer training on the digital tools available (mobile applications, online banking, etc.). Gather feedback to improve the onboarding process.

What solutions for an efficient KYC customer onboarding process?

To optimize and guarantee the efficiency of your customer onboarding KYC process, various solutions can be adopted. Each one meets specific safety, compliance and accessibility requirements. Choosing a customer onboarding solution adapted to your needs is crucial: combined with best practices, you can significantly increase your conversion rates. Here’s an overview of existing solutions:

The eIDAS Qualified Electronic Signature

Under the eIDAS (Electronic Identification, Authentication and Trust Services) regulation, the Qualified Electronic Signature (QES) is the signature with the highest level of security and legal recognition in the European regulation. It enables your customers to electronically sign documents online, with the same validity as a handwritten signature. Implementing qualified electronic signatures in your digital onboarding builds trust and formally validates customers’ identity and agreement with your terms of service, making the whole process both transparent and legally sound.

Netheos QES solution

Identity Verification Solutions PVID Certified by ANSSI

of the Netheos PVID solution

PVID (Prestataire de Vérification d’Identité à Distance) certified identity verification solutions, accredited by the ANSSI (Agence Nationale de la Sécurité des Systèmes d’Information) in France, ensure standardized, secure identity verification. These solutions are based on rigorous criteria defined in the agency’s PVID repository to validate customer identity in a reliable and recognized way. By integrating these certified solutions into your onboarding approach, you mitigate the risk of identity fraud and comply with the most stringent regulatory requirements, a crucial point particularly in sensitive sectors such as finance and banking.

Digital Identity and its European Portfolio

With the development of digital identity and the European Identity Wallet initiative, customers will be able to authenticate themselves and prove their identity online in a secure, EU-wide recognized way. The adoption of this government-designated digital identity solution enhances the fluidity of customer onboarding, facilitating cross-border transactions and ensuring compliance with European identification and personal data protection standards.

KYC Remediation

KYC remediation is the process of updating and correcting customer identification data to ensure continuity of regulatory compliance and customer information over time. Remediation is essential, as it enables customer files to be refreshed in line with regulatory changes or changes in customer status. By integrating remediation processes into your digital onboarding strategy, you maintain the accuracy of customer profiles and proactively meet KYC requirements throughout the customer relationship.

Make an appointment with one of our experts to find out how Netheos solutions can help you verify the identity of your users, securely and without loss of conversion.

- KYC for banks: role and impact in 2023

- What is KYC in crypto?

- What is Regtech?

- Artificial intelligence: impact on KYC in 2023

- Identity verification: which KYC solution is right for you?

Fill in the form and we will contact you as soon as possible.

You can discover :

- How we can meet your specific needs and expectations

- A personalized demo, allowing you to appreciate the fluid experience we offer

- Customer feedback and case studies of similar companies that have integrated our solutions

- Advantages, benefits and value according to your use case