The Netheos Trust and Sign solution automatically checks the bank statements of individuals or companies to determine whether they have been falsified.

Compliance checks

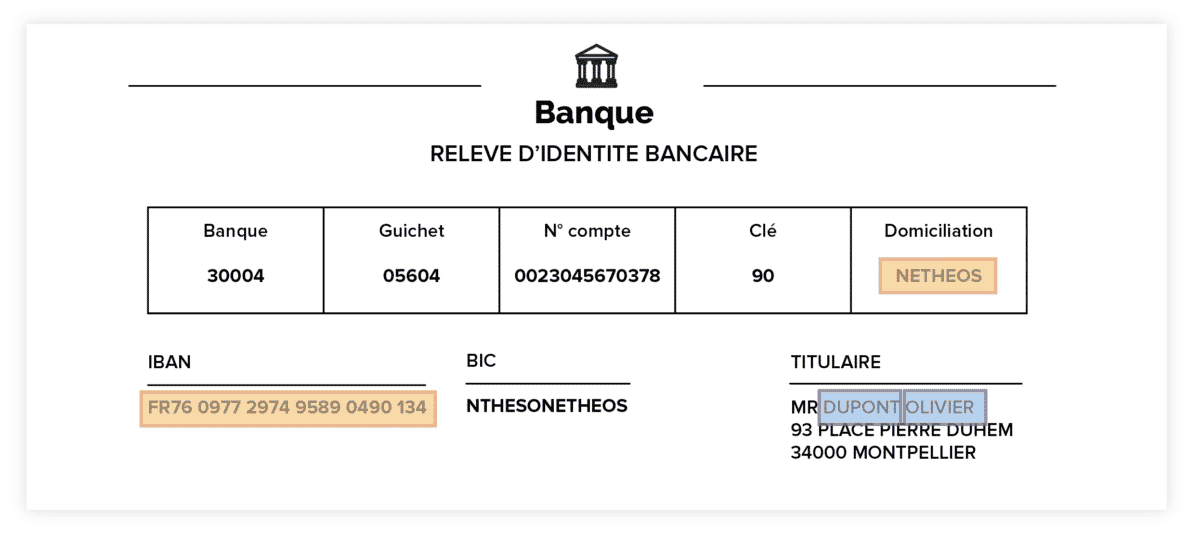

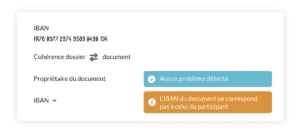

After validating the quality of the document image (is it usable?), Trust & Sign verifies that it is indeed a RIB (is it the right document?). To take compliance checking a step further, you can configure a search list of expressions (e.g. “curatelle”). This will filter the RIBs you wish to accept. Bank account domiciliation can also be restricted to a list of countries. Finally, the Netheos solution ensures that the data contained in the document is consistent with the reference information previously entered in the subscription form.

Authenticity checks

Controls

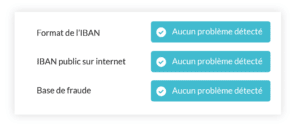

SEPAmail DIAMOND

Trust & Sign interrogates SEPAmail DIAMOND to verify the existence of the bank account with the issuing bank. The IBAN, automatically extracted from the RIB, is checked against the customer’s personal data (surname, first name, date of birth). This verifies that the bank account exists and that the user is the owner. In the case of a legal entity, the SIREN is also checked.

All these controls can be configured in the Trust and Sign interface. You can choose which checks you want to perform, and make them mandatory, optional or blocking. Automatic verification of the RIB means that any attempts at fraud are detected, and that customer files are reliable, complete and compliant in the shortest possible time.